- Call: +1.866.874.7932

Dynamic discounting, also known as “early-pay discounting,” is a feature of enterprise-level automation where customers are able to receive a discounted price, simply by paying their invoice early. This also provides suppliers with ample time to be notified that the invoice is approved and can be paid early, improving their cash flow.

iPayables uses advanced algorithms in real-time to determine the appropriate discount for the supplier and customer based on the selected date and terms previously decided on. The supplier agrees to the dynamic discount and can look forward to a payment that meets their schedule. Once the supplier decides the date that they want to be paid for their product or service, InvoiceWorks® automatically calculates the discount amount. It’s that easy.

Accounts payable departments have started realizing more and more that paper and other manual invoicing are simply outdated. When it comes to payments and supplier relationships, these lower-level processes put your department at a major disadvantage. Manual invoicing, such as paper and emailed PDFs, is time-consuming, and threatens the risk of late fees—with little promise of getting your invoices paid early. Low-level automation also lacks the guarantee of an expedited payment process. Many times, with low or partial automation, you’re spending unnecessary money while your department still has to do the majority of the tasks.

When payments take longer to process, the “frozen” capital is temporarily unavailable for the supplier’s organization to use in other areas. Buyers typically want to balance retaining capital while also maximizing discounts. In the past, buyers have tried to negotiate discount terms that meet capital cost requirements set by their treasury. However, suppliers don’t always want to be stuck with such a long-term commitment. Additionally, these lengthy payment periods disrupt your suppliers’ cash flow, which can strain your relationships with them.

With iPayables’ enterprise-level e-invoicing solutions, payments are processed exponentially faster than traditional paper or lower-level automation processes. Faster processing provides a multitude of opportunities to pay your invoices early. Early payment of invoices then opens up the door for dynamic discounting, which enables you to save your department money by taking advantage of supplier-offered early-pay discounts. This is also a huge benefit to your supplier because it improves their immediate cash flow. When your suppliers are happy and paid, it paves the way to improved supplier relationships.

Through iPayables InvoiceWorks®, your department is able to select the date they’d like to pay their invoice ahead of time. The exact discount is calculated based on the day that you select. Suppliers can choose to accept the date and the early-pay discount, or can propose a new date, for which the new discount would automatically be determined. This makes cash flow forecasting more accurate and relieves some of the reporting burden placed on the accounting department.

In order to engage in dynamic discounting, your suppliers must be able to access invoices electronically. Luckily, when you choose iPayables, our vendor adoption team starts helping your suppliers get set up on the free supplier portal on day one. Once you’ve provided supplier information, your department doesn’t have to lift a finger to move suppliers to the portal. With iPayables taking care of the vendor adoption, and enterprise-level automation speeding up the e-invoicing process, your department will be left with incredible time and savings opportunities.

With invoice processing times being expedited and all of your suppliers onboarded thanks to enterprise-level AP automation, your department will have significantly more time on its hands to focus on higher-level tasks. This includes using their time to negotiate with suppliers and capture discounts with iPayables’ dynamic discounting features. With dynamic discounting, capturing discounts and paying invoices early saves you money, which is a huge benefit not only to your department, but to your entire company.

With iPayables’ dynamic discounting opportunities, payment options become flexible. Based on agreements with suppliers, you’re able to choose from a range of dates to pay your invoices and the best method of payment for you and your supplier. With the selectable range, your department is able to choose the date that works best for you. That means no pressure to have your payment submitted by one exact deadline—you’re still able to capture discounts as long as it falls within the early payment range.

Dynamic discounting with iPayables gives increased control to your department. With invoices processed faster, you have clear visibility into when your invoices are able to be paid, and what (if any) invoices are coming up on their payment deadlines. With such improved visibility, you’re able to take control of your department and your payments—and take charge of capturing discounts.

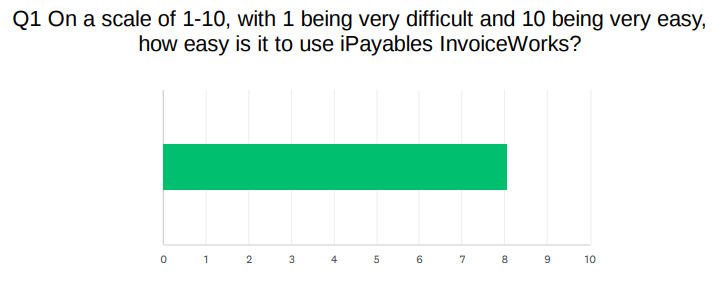

With an enterprise-level AP automation solution such as iPayables, suppliers are given better visibility into the invoicing process. Dynamic discounting is one of the great benefits that come from an enterprise-level solution, as discounts become easier to negotiate between customer and supplier. Plus, an annual survey of suppliers shows that they find the portal easy to use, and even enjoy using it!

Source: iPayables 2022 Supplier Survey Report

Why Switch to E-Invoicing?

Do I need to install anything on my computer?